A few weeks ago, a Stanford colleague stormed into my office. He had ordered some groceries from Instacart, a buzzy get-it-now startup that recently raised $44 million. My friend thought he had paid a flat $3.99 for delivery from a local store. In fact, he had paid about $20 net of store prices. How, he fumed, could this be legal? From a quick Googling, he isn’t the only one steamed about Instacart’s subtle surcharge.

Measuring the Markup

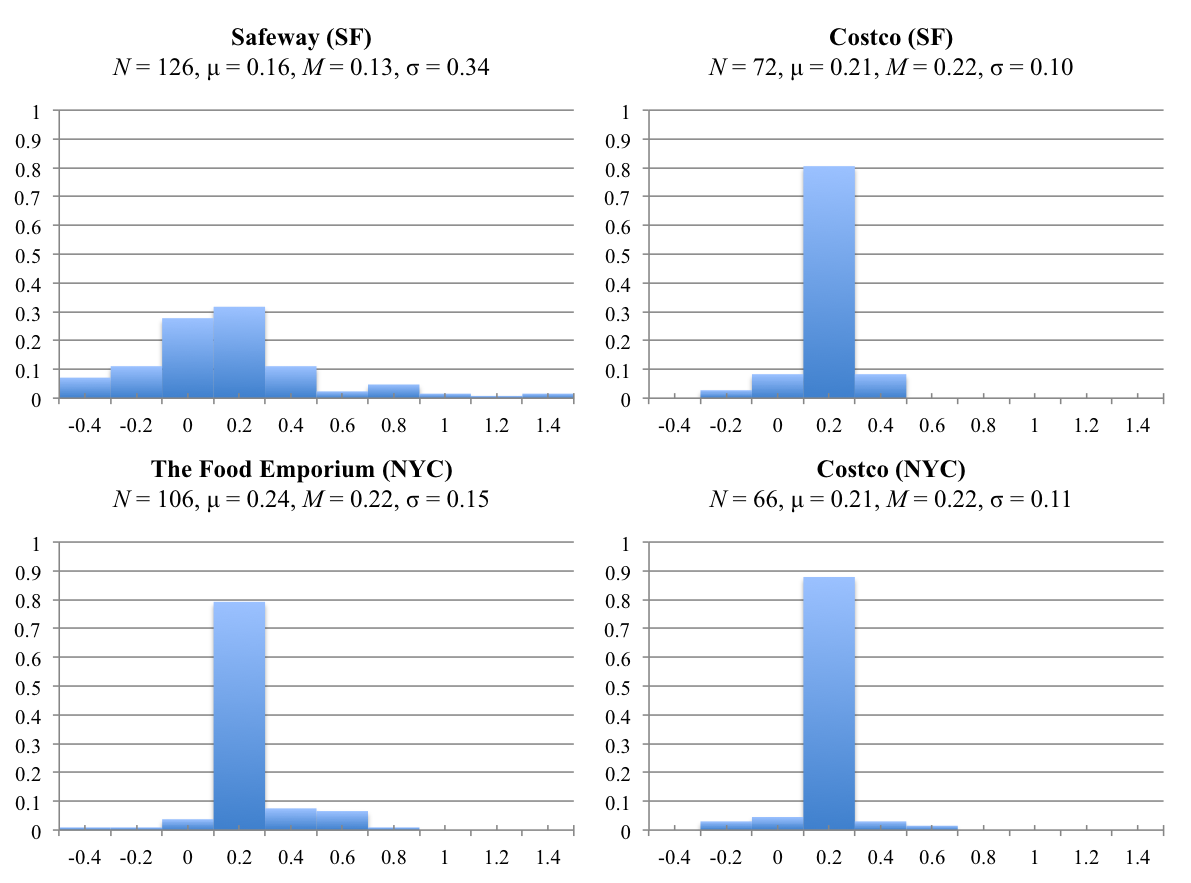

In an attempt to estimate the Instacart commission, I picked four stores: Safeway and Costco in San Francisco, and The Food Emporium and Costco in New York City. I built a basket of goods for each store, using what was “Popular” on Instacart. Finally, I compared Instacart’s prices with store prices.1 All of my data is available on a spreadsheet. The following histograms reflect relative price differences.2

A few results are apparent. First, Instacart unambiguously charges a premium. As a rule of thumb, the markup is 20%. This finding is roughly consistent with previous informal estimates. Here’s an example, to illustrate the effect: an order that appears to be $50 of groceries with a $3.99 flat delivery fee is, in fact, about $41.67 of groceries and $12.32 in delivery expense. Yikes.

Second, Instacart’s premium is not specific to a geographic market. Both San Francisco and New York City exhibit increased pricing. The legal implication is that Instacart’s business model must pass muster with multiple states’ consumer protection laws.

Third, the distribution of the markup varies from store to store. I could only speculate as to why.3

Fourth, there are substantial outliers in both directions. Instacart did have a few steals, such as nearly-half-off avocados at Safeway and The Food Emporium. It also had some astonishingly awful deals, though, such as 86% inflated Simply Orange juice at Safeway and 70% marked up cans of Coke at The Food Emporium.

I also noticed that Instacart’s “Extraordinary Value” notation has questionable meaning. For example, Instacart featured a bottle of Domain Chandon Brut for $16.09 from Safeway. The very same sparkling wine was 10¢ less at Safeway and competing local stores. Not much extraordinary about that value.

So, is all this legal? Consumer protection law involves a fact-intensive inquiry into how ordinary consumers perceive a business, and whether they would be misled.4

In Defense of Instacart

There are a couple good facts for Instacart. The service does have a disclosure.5

Are your prices different from the store?

Yes, Instacart prices are our own and vary from the store’s price…

The legal effect of this passage is debatable, though. A shopper would have to navigate to the FAQ and scroll down to find it. Furthermore, the text notes only that Instacart’s prices are different—not that they are higher, and not how much higher.

Instacart also benefits from some news coverage and online discussion, which have explained that the service relies on a markup. For those paying particularly close attention, the contours of the business model are plainly not a secret.

The Case Against Instacart

There are, on the other hand, a number of bad facts. The worst, perhaps, are Instacart’s own pricing explanations. Representatives have variously claimed that the markup is “nominal,” just a “touch” higher than in-store pricing, “slightly different than what is in stores,” and “a little different than what you would see at the grocery store.” Good luck squaring that with a 20% commission.

What’s more, some of Instacart’s descriptions create a predictable false equivalence, such as “prices are a bit higher or a bit lower” and “our prices are lower or higher than the stores’ prices, sometimes they are the same.” Yes, all these price relationships are possible, but they hardly occur with equal probability. An earlier version of the Instacart FAQ included similar language but, tellingly, the text was removed.

Assuming it is authentic, a 2013 pitch deck that I stumbled across is also problematic.

When explaining its business model to investors, Instacart puts the markup front and center. When dealing with shoppers, Instacart buries the lede. Differential messaging sure looks bad under consumer protection law, and the deck suggests more might come out in discovery.

Instacart’s pricing structure may also contribute to consumer confusion. The service promotes “free” delivery for new customers and flat delivery fees for repeat shoppers. When explaining “delivery cost,” the FAQ nowhere suggests that product prices are a factor. A customer could trivially assume that listed fees are the sole or primary source of delivery expense.

The Instacart experience is another knock, since it is designed to mimic shopping at your local store. A user begins by selecting a grocer, then navigates by department. After placing an order, contractors actually go to the store and make the purchase. It is easy to see how a shopper might erroneously assume that Instacart charges roughly in-store prices.

Instacart’s alcohol pricing FAQ highlights the firm’s tenuous position.

Are your alcohol prices different from the store?

No, but we add a delivery fee to the store’s price for each item you purchase. This is why the prices listed on our website appear to be higher than those charged in the store.

Apparently a surcharge on booze is a “delivery fee,” while a markup on everything else is a “vary[ing]” price. The purpose of this passage is, presumably, to sidestep alcohol sales law. In the process, though, it emphasizes how an inflated price is functionally equivalent to a delivery fee.

Instacart’s peers pose a final problem. Much of the latest crop of same-day delivery services rely on transparent fees, including Postmates, TaskRabbit, Google Shopping Express, and eBay Now.6 These offerings function like flat-rate courier services, not a corner convenience store. Since Instacart’s competitors don’t include a markup, consumers might not expect it.

Concluding Thoughts

Instacart operates in a gray area. The business model is certainly close to the legal line; which side it falls on, I can’t say.7 I informally polled a group of lawyer friends for their views, and all agreed that Instacart had substantial exposure to law enforcement and private litigation risks. (I wonder if investors were aware.)

Setting aside the law, Instacart’s business model is quite unsavory. Instacart is plainly designed with the intent and effect of hiding the true cost of grocery delivery. Uncool.

The possible fixes are obvious and easy: Wherever the service discusses its delivery fees, for example, it could also note its approximate markup. Alternatively, it could note the expected premium next to prices, in the shopping cart, or on the checkout page.

I am all in favor of “disrupting” the grocery store. Just not by misleading shoppers.

Usual disclaimer: I am a lawyer, but this is not legal advice.

1. This methodology may introduce a slight bias in Instacart’s favor, since shoppers who recognize the surcharge may select better values.

Prices for Safeway and The Food Emporium are taken directly from those stores’ websites. The pricing includes available discounts. (In my experience, it’s not even necessary to have a card at these stores—politely asking a cashier is sufficient.) Prices for Costco are from Google Shopping Express, which appears to reflect in-store pricing. (Costco has an online business delivery service, but it seems to have different prices.)

I assume that Instacart separately charges applicable taxes, since that has been my experience using the site. To the extent Instacart’s prices include taxes, the surcharges reported here should be discounted that much. They would still be substantial.

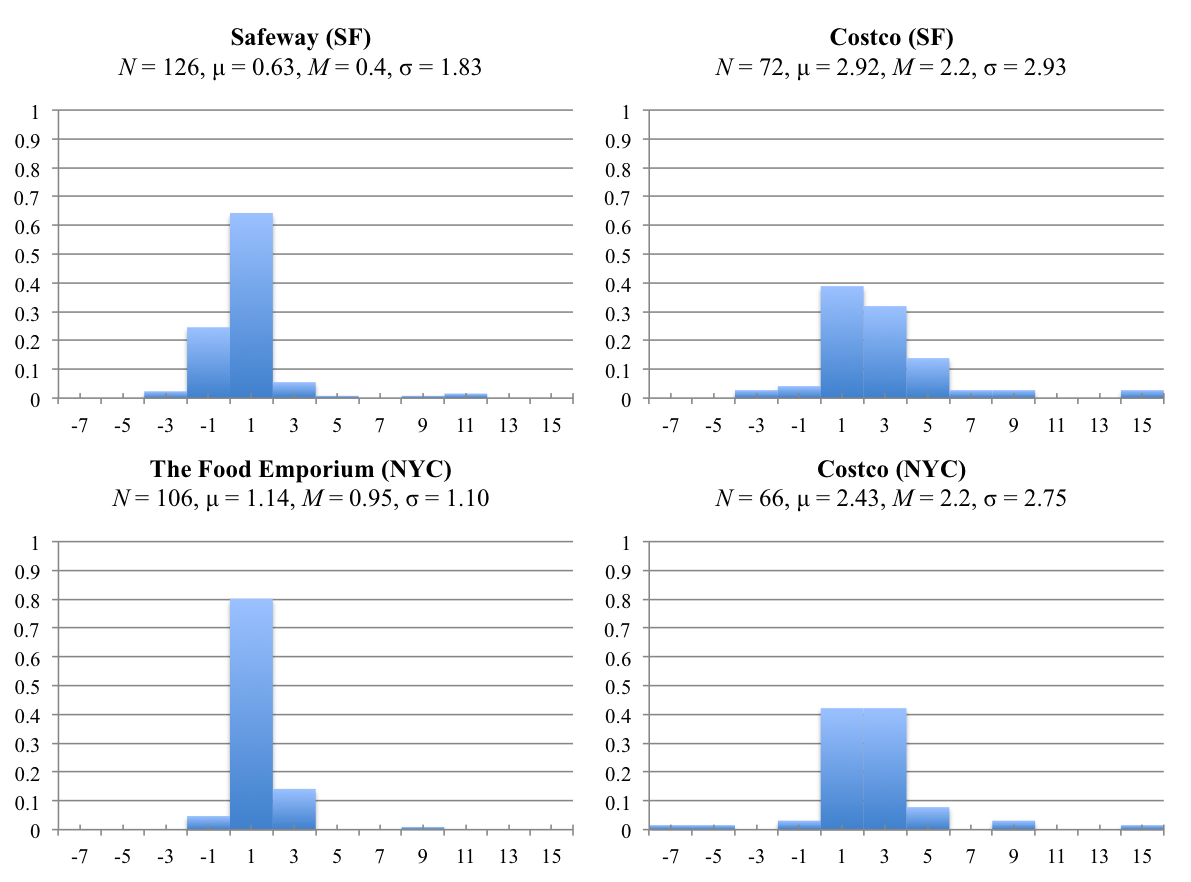

2. I also generated the following histograms of absolute price differences.

These distributions are generally less concentrated than the distributions for relative price differential, so I focus the discussion there.

3. I imagine factors include Safeway’s notoriously fickle discounting, the frequency with which specific items are ordered from specific stores, and amortization of the Costco membership fee.

4. For simplicity, I lump together the usual consumer protection causes of action (including unfair business practices, deceptive business practices, false advertising, and common law fraud). The specifics of these claims differ, to be sure, and vary by jurisdiction. For purposes of Instacart, though, the causes largely reduce to the same factual issue.

5. The Instacart “Terms and Conditions” also include this passage.

The additional fee Customer pays that is above the retail price of the Groceries is for the purpose of engaging the Personal Shopper to perform the Personal Shopper Services.

Read in context, this passage is an explanation of the customer’s business relationship with Instacart and its independent contractors. The provision explains why fees are charged, not how fees are charged. A flat delivery fee would also be within the meaning of this text—and has to be, since the document nowhere else addresses payment for grocery delivery.

6. At least one other get-it-now startup, DoorDash, uses inflated prices. The specifics of the business model differ (restaurants choose whether and how much to increase prices, not the delivery service), and there is clearer disclosure in the website’s FAQ.

7. The closest analogy that comes to mind—and it’s hardly a perfect fit—is litigation over inflated currency exchange rates. Courts have squarely split on the issue.